Do you rely on your home country to prepare for your retirement ? Do you still believe the ‘traditional’ retirement scheme will be there in 20-30 years ? If yes then you must read this article and learn how you can start to implement a long-term diversified portfolio.

For the more advanced readers … is your way of building a diversified portfolio accurate?

The short answer is “Yes”, the long answer is “Probably”. There is no right and wrong in the way you build an effectively diversified portfolio. It depends on which direction you want to go and what you have to make a “diversified” portfolio.

Since everything about the diversification of a portfolio varies, it’s a large area to cover. Therefore, I hope that a few suggestions in this article will help you visualize better the right ways to diversify your portfolio.

For me, the four important opponents to create a diversified portfolio are:

Focusing on different sectors

You may not want to invest in only one single stock or sector when you’re looking to ensure your financial security. There are times when buying six stocks in one industry can damage your asset badly due to the lack of diversification. If the sector is doing great during a period, all the six stocks will profit which is good news.

However, the chance for such a thing to happen is very unlikely. The market can adjust unexpectedly due to a lot of factors. Therefore, you may win it all. But at the same time, you may lose it all as well.

https://www.youtube.com/watch?v=sN2WsjEsXzs

In this video, you will learn about :

- What are the common myths of managing personal savings and investment?

- What’s the difference between day trading and long-term trading?

- How to build a cost-effective diversified portfolio?

- What to do next after having a stable and diversified strategy ?

- How to include future cryptos and NFTs in a long-term strategy ?

Therefore, the best move to carry out is to invest in stocks of different sectors (For example Technology, Pharmaceuticals, manufacturing, etc) to balance between loss and profit. If one sector falls, there will be others sectors to back you up which increases the possibility to earn more profits.

Bonds

Bonds is another fascinating option if you look forward to diversifying your portfolio. Bonds are known to offer a regular interest. Also, they contain fewer unexpected risks compared to stocks. Therefore, bonds seem like a good solution for those who want to stabilize their base on the safety aspect of investment. However, everything contains both advantages and disadvantages. Even though bonds are safer to invest in, their long-term returns are also less than stocks investment.

Therefore, if you’re someone who prefers safety to growth, bonds are the choice for you. There’s one thing worth noticing is that you can receive higher returns by buying international bonds or high-yield bonds. However, that also comes with a higher rate of risk.

International stocks

As cosmetic stocks may have certain restrictions, buying international stocks helps solve the problem which builds up a sustainably diversified portfolio. However, international stocks also include higher risks because it provides higher potential returns.

Alternative investments

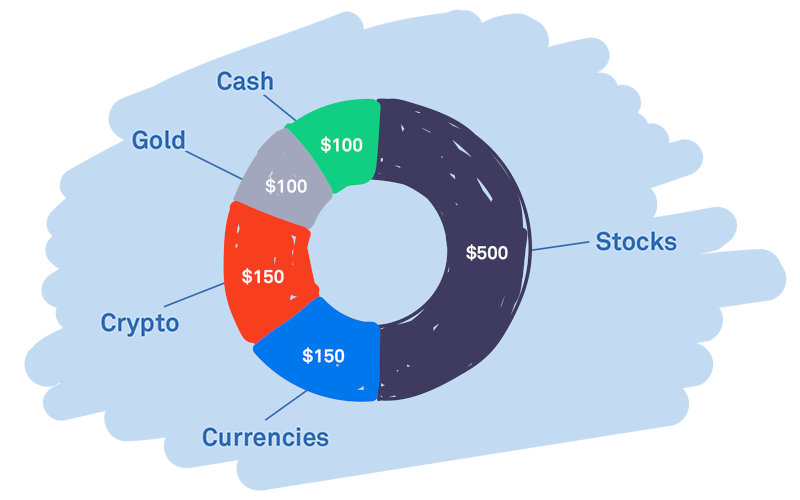

There are also other alternatives to invest in if you want to diversify your portfolio. Alternative investments include investing in real estate, venture capital, hedge funds, commodities, and what most people have been showing much interest in: Cryptocurrency.

In the commodities section, you can choose to invest in natural resources such as oil and gold. Gold is the most popular form of alternative investment because it is proven to rise in value after 15 days of a crash. Moreover, it’s one of the few options that you could apply to defend against inflation.

And more helpful sharings about building a diversified portfolio in the video above that should be handy for your upcoming journey. I hope this basic information aids your expectation for a better diversification plan

To learn more about diversified investment strategies as well as the perspective of an expatriate living in Vietnam, you can have a look at this in-depth guide for expats as well as download for free my book highlighting the 7 mistakes I made while living in Asia about business, long-term residence and investments.